Mexico’s energy system relies heavily on U.S. natural gas and this could lead to price increases and supply shortfalls if the United States focuses more on the liquefied natural gas (LNG) export market, according to analysts at Fitch Ratings Inc.

If the U.S. increases gas exports to Europe as a result of Russia’s invasion of Ukraine, “Mexico could face high gas prices and shortages,” said Velia Valdes, an associate director in Latin America Corporates. She spoke during a webinar Fitch organized on the Mexican energy sector.

So far, the Russia-Ukraine crisis hasn’t had a visible impact on U.S. natural gas pricing. Given infrastructure constraints, the United States also cannot in the short term produce more LNG than it already is producing.

Valdes said Winter Storm Uri in Texas last year, which left millions of Mexicans without power, highlighted Mexico’s exposure to external dynamics.

“Currently, roughly 60% of the country’s electricity is generated by gas fired-power plants,” Valdes said, and “this percentage will continue increasing in coming years” as new combined cycle plants and pipelines are under construction.

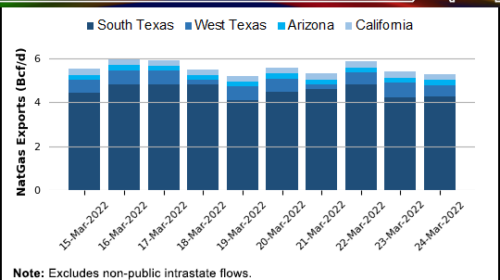

Mexico is “highly dependent on U.S. gas imports.” They account for more than 75% of natural gas demand, and Texas represents 86% of this figure, she said.

Valdes said Mexico’s lack of domestic gas production and storage facilities exposes the country to gas shortages, as well as fluctuations in Henry Hub prices and exchange rates.

She cited the fact that Mexican state utility Comisión Federal de Electricidad (CFE) in 2021 saw costs rise 70%, in line with higher U.S. natural gas prices.

“A bilateral mechanism of cooperation, policy integration and an official trade relationship with the U.S. are key factors for Mexico,” Valdes said. “The failure to address U.S. concerns regarding the protections of its investments could have significant consequences.”

Reform Unlikely To Pass

Mexico’s energy sector in recent years has been marked by government moves to try to favor CFE and Petróleos Mexicanos (Pemex) over private sector competition. U.S. energy firms and companies have complained of unfair treatment.

During the administration of President Andrés Manuel López Obrador, “We have seen numerous attempts at increasing the state participation in both the energy and electric power sectors,” Carlos Morales, director, Latin America Sovereigns, said during the webinar.

“However,” he said, “these attempts have been suspended by Mexican courts.” This in turn has led to a government-sponsored constitutional initiative to push through an electric power reform. The reform seeks to increase CFE market control to at least 56%, favors CFE in power dispatch, cancels self supply contracts, and gets rid of autonomous regulators. The key component, Morales said, is that “it transforms CFE into a monopoly.”

Morales, however, said Fitch doesn’t see the reform going through “in its current form.” This is because the president’s party Morena lacks a two-thirds majority in the senate and lower house. Meanwhile the main opposition party, the Partido Revolucionario Institucional (PRI), has said they won’t discuss it until upcoming regional elections. PRI leadership has also said the proposal would need changes before any consideration.

“PRI is pivotal,” Morales said. He sees the reform probably going to debate in late 2022. But this doesn’t preclude the government from “continuing to push for it and a wider control of the state” in the energy sector in the meantime.

Even if a version of it were to be approved, Fitch sees arbitration from private investors through trade treaties stalling its progress.

“We have already seen the appetite for investment has diminished” in the sector during this administration, Morales warned. Elimination of self supply contracts would also raise costs for many companies and impact competitiveness.

Investment in the power segment has shrunk from around $5 billion in 2018 to under $1 billion in the past two years. Fitch sees Mexico’s power sector demand growing 3.2%/year for the next 15 years. To meet this demand, $10 billion/year in investment would be needed through 2035.

This investment would be hard to achieve if the reform were approved, leading to “a lag in economic growth” vis a vis regional peers, Morales said.

Natural Gas Operators Unimpacted

The Fitch analysts said natural gas midstream companies like Mexico’s Fermaca wouldn’t be impacted by the reform.

Valdes said Fitch doesn’t anticipate any new changes in gas transport agreements. In 2019, the Mexican state renegotiated pipeline contracts with a series of private sector firms.

Jesus Enriquez, director, Latin America Infrastructure and Project Finance, said there is so far “limited impact on natural gas pipeline projects.” He said the regulation agencies would remain intact in the midstream natural gas segment.